This post was written on April 20th, 2025

I have been desperately waiting for E-Comm’s in India to IPO so that the public gets more visibility into data like the AR released by Meesho. I am amazed by Meesho’s numbers for two reasons:

- ~19 crores Annual Transacting Users (1 in 8 Indians) – This figure is more impressive when you consider the base as not 1.4 billion but look at segments with some disposable income.

- According to Blume’s Indus Valley Report:

- India 1 – 14 crore individuals who annually make ~13 lakhs/person

- India 2 – 30 crore individuals who annually make ~2.5 lakhs/person

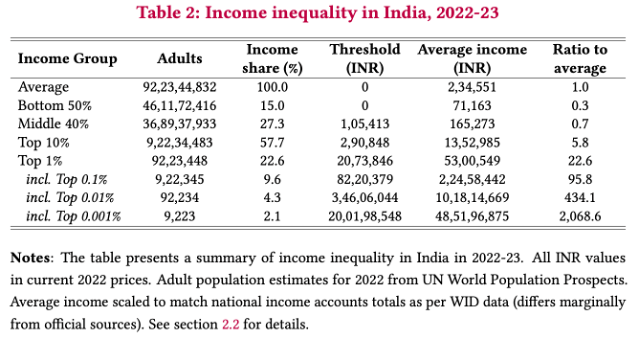

- Blume’s numbers are further corroborated by this academic paper from the wealth inequality lab:

- According to Blume’s Indus Valley Report:

There is a high likelihood that bulk of these transacting users belong to India 1 or 2. India 3 with such low income per capita is not monetizable. It wouldn’t be too farfetched to assume Meesho has successfully converted 30-40% of India’s true “TAM” into revenue contributing customers.

- Achieving profitability (Almost there): Meesho has a 0% commission policy for all suppliers, similar revenue model to Alibaba’s Taobao in China.

In FY24, marketing spends was slashed by ~50% but they still grew 31% YoY. They have mastered outreach through organic channels. Given low AOVs b/w 300-400, logistics cost/order around is somehow brilliantly contained to ~45 rupees. I couldn’t get industry benchmarks for logistics cost, but have a feeling 45 po is as low as they come for B2C retail.